Why Dubai Landlords Face a Strategic Choice

Dubai’s rental market in 2025 is at its most competitive point yet. The city has become a magnet for global residents, remote workers, and tourists, creating a demand surge across both short-term holiday homes and long-term rentals. For landlords, the key decision revolves around holiday rental vs long term rental Dubai. The choice is not limited to the duration of tenancy but also about maximising Dubai property investment returns, balancing risk exposure, and aligning with financial goals. Understanding these dynamics helps identify which model generates stronger performance in 2025.

Population growth, visa reforms, and international investor attention are fuelling this demand. At the same time, the steady flow of tourists from Europe, Asia, and the GCC supports short-term occupancy levels, while multinational companies relocating staff increase long-term tenancy requirements.

Key Differences Between Holiday Homes and Annual Rentals

Management and Legal Requirements

Holiday homes require approval from Dubai’s Department of Tourism and Commerce Marketing (DTCM). Owners must comply with specific guest management rules, safety standards, and furnish the property to approved levels.

Long-term rentals, however, are managed under RERA tenancy laws and require Ejari registration. These contracts typically run for 12 months or more, bringing predictable income and fewer operational demands.

Tenant Types

- Holiday Homes: Attract tourists, business travellers, and digital nomads who typically stay from 3 nights to 3 months.

- Annual Rentals: Attract residents such as professionals, families, and long-term expatriates seeking stability.

Quick Comparison Table

Factor | Holiday Homes | Annual Rentals |

Licensing | DTCM Holiday Home Permit | Ejari Tenancy Registration |

Occupancy | Seasonal and fluctuating | Stable year-round |

Income | Higher daily rates | Steady monthly rent |

Management | Guest turnover, furnishing, cleaning | Minimal once tenant is in place |

Flexibility | High – owner can use property | Low – tied to annual lease |

This contrast explains why short-term vs long-term rental Dubai continues to divide investors. Location plays a major role: properties in Downtown or Marina may excel on Airbnb, while suburban villas may suit annual tenants better.

The Airbnb vs annual lease Dubai debate is not just financial, but also operational, depending on how much involvement an owner is ready to commit.

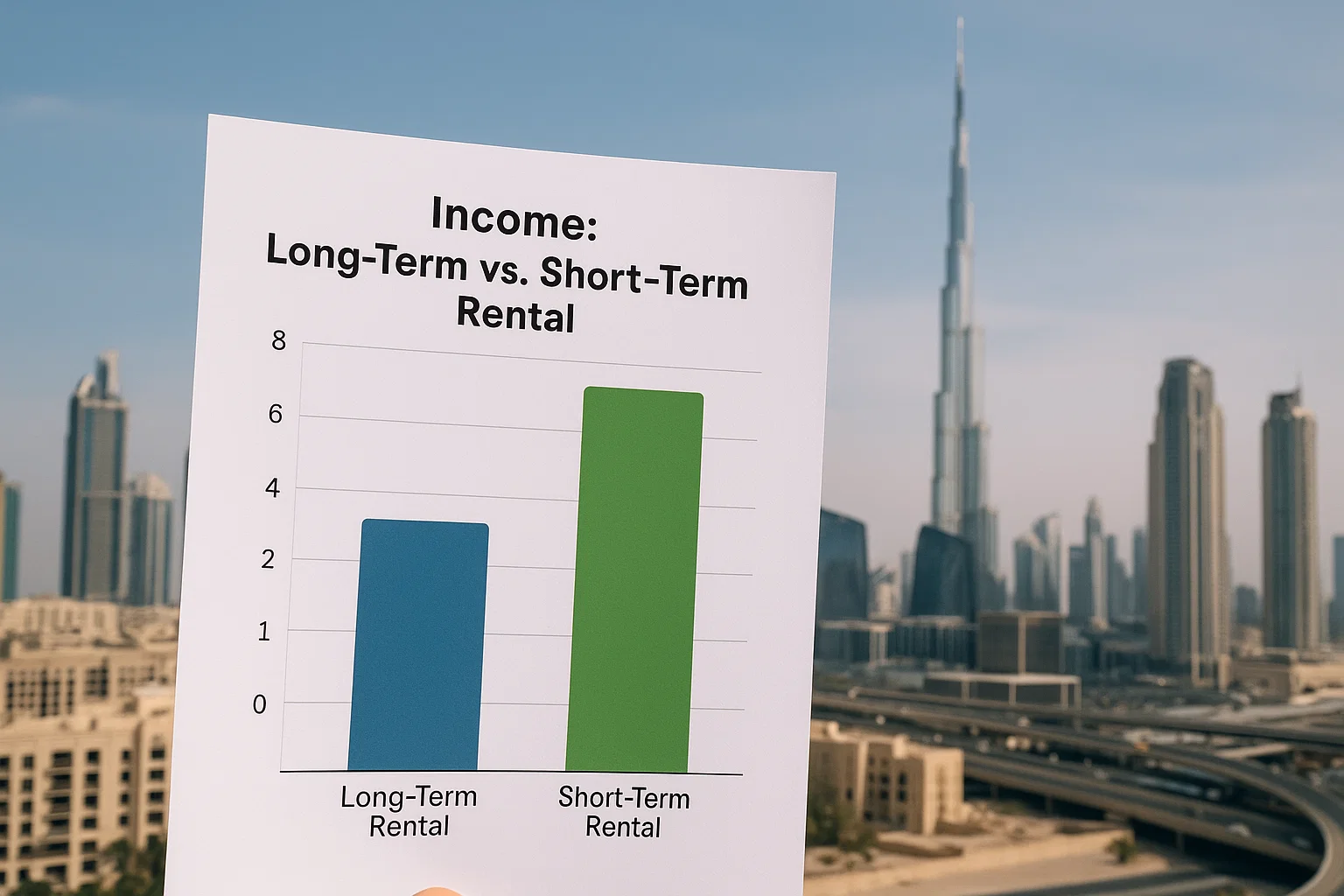

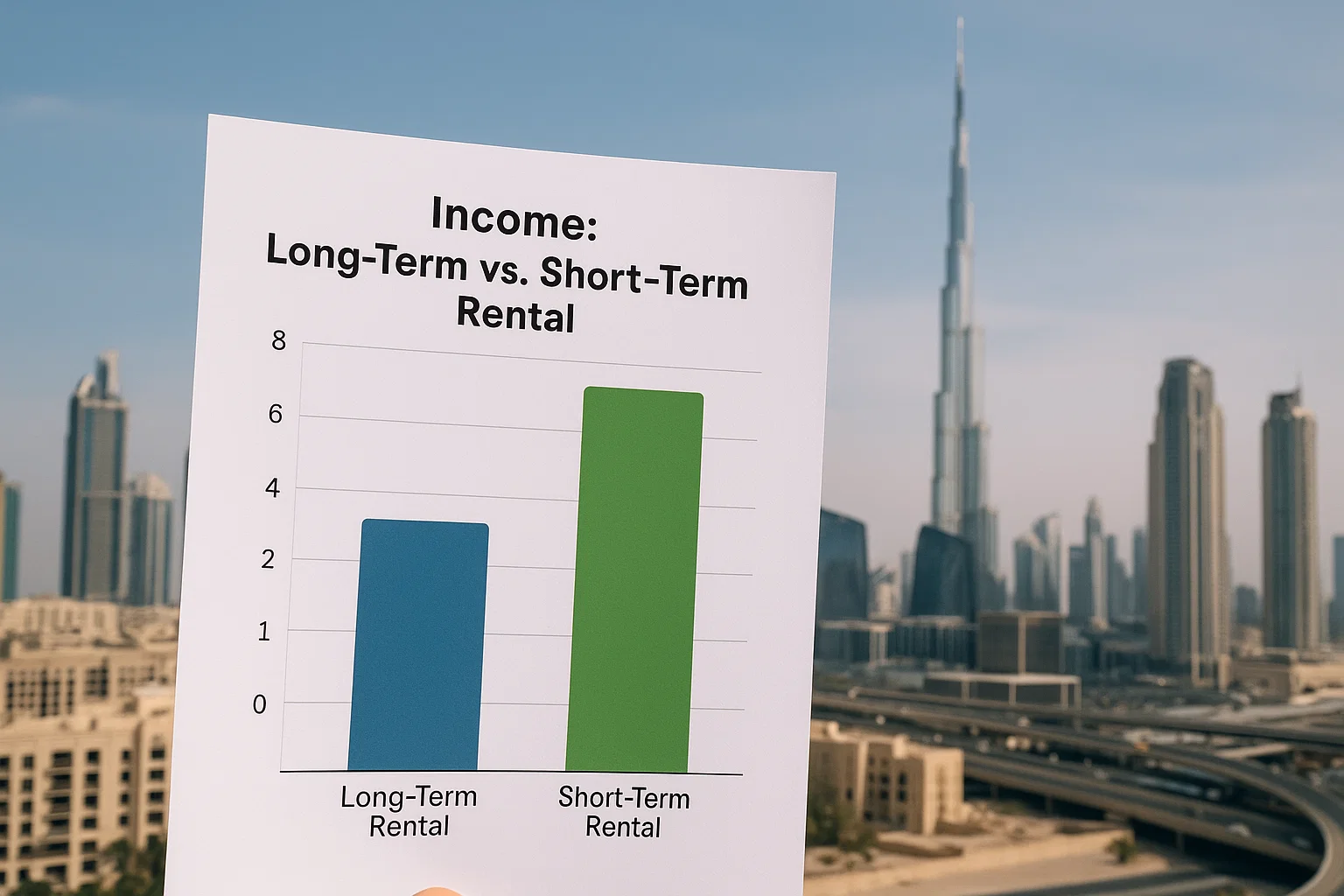

Revenue Comparison – Which Brings Higher Income?

At the heart of the decision is profitability. Many landlords ask: which rental strategy makes more money in Dubai?

Example Scenarios

- 1-Bed Apartment in Business Bay:

- Annual rent: AED 95,000 (~AED 7,900 per month).

- Airbnb: AED 550 per night. At 70% occupancy, monthly revenue reaches AED 11,500.

- 2-Bed Apartment in Dubai Marina:

- Annual rent: AED 140,000 (~AED 11,600 per month).

- Airbnb: AED 850 per night. At 75% occupancy, monthly revenue can reach AED 19,100.

- 4-Bed Villa in Jumeirah Islands:

- Annual rent: AED 450,000 (~AED 37,500 per month).

- Airbnb: AED 3,000 per night. At 65% occupancy, monthly revenue can exceed AED 58,500.

This shows why Dubai rental income comparison is critical. For some owners, Airbnb income Dubai significantly outpaces annual leasing, but the model depends on location, demand, and efficient management.

Villas vs Apartments

- Apartments in popular tourist areas (Dubai Marina, Downtown, JVC) usually perform well as holiday rentals.

- Villas with unique layouts and private pools often achieve strong Airbnb returns, though they come with higher operating costs.

Cost Breakdown and Net ROI

Revenue alone does not determine profitability. Expenses reduce returns significantly.

Holiday homes include:

- DTCM licensing fees

- Holiday home management charges (15–25% of revenue if outsourced)

- Furnishing, utilities, Wi-Fi, and housekeeping

- Vacancy gaps during low season

Long-term rentals include:

- RERA tenancy registration fees

- Service charges (shared by all owners)

- Standard maintenance and occasional refurbishments

By calculating service charges and net ROI Dubai, investors can measure realistic profitability. For instance:

- A holiday rental generating AED 11,500 per month, with AED 3,500 in costs, leaves AED 8,000 in net income.

- A long-term lease at AED 7,900 per month with AED 1,000 costs leaves AED 6,900 net income.

This shows why investors must evaluate long-term rental ROI Dubai carefully before deciding.

Occupancy and Seasonal Demand

Short-Term Variability

Holiday homes follow Dubai’s tourism calendar. During peak months (October–April, major exhibitions, Expo events), occupancy rates can exceed 85%. During summer, demand drops, and landlords face 50–60% occupancy unless priced competitively.

Long-Term Stability

Annual contracts bring consistent monthly payments regardless of tourism trends. This stability appeals to landlords seeking predictable returns.

Investors comparing short stay vs full-year tenant strategies must weigh the risks of seasonality.

Profitability Outlook

Despite fluctuations, Airbnb Dubai profitability often outpaces annual leases in prime tourist zones. However, landlords prioritising guaranteed monthly income prefer long-term tenants.

Investor Profiles Best Suited to Each Model

Holiday Home Landlords

Short-term rentals suit owners who:

- Want higher income potential

- Have properties in tourist hotspots

- Are comfortable with active management or hiring a manager

- Accept seasonal risks for higher upside

Long-Term Landlords

Annual leases suit owners who:

- Seek consistent monthly income

- Prefer low maintenance involvement

- Own properties in residential communities outside tourist hubs

- Value tenant stability over flexibility

For many, the best rental income strategy Dubai comes down to matching property location with risk tolerance.

Understanding Regulations and Compliance

Dubai enforces clear rules for both models.

- Airbnb regulations Dubai require a DTCM holiday home licence, compliance with safety standards, and regular reporting.

- Annual leases must be registered through Ejari and follow tenancy law, including notice periods and rent caps.

Failure to comply can result in fines or rental suspension. For landlords, regulatory awareness is just as important as yield forecasts.

How to Decide Which Model Fits Your Property

Choosing between the two strategies requires structured evaluation. Use the following checklist:

- Location: Is the property in a tourist area or residential community?

- Expected ROI: Use a property ROI calculator Dubai to model different scenarios.

- Lifestyle Goals: Do you want flexibility or predictable income?

- Vacancy Tolerance: Can you sustain low-occupancy months?

- Compliance: Are you prepared for licensing and ongoing reporting?

This helps landlords align decisions with both holiday rental vs long term rental Dubai and broader Dubai property investment returns.

From Numbers to Actionable Strategy

The comparison between short stays and annual leases is not purely about higher revenue. It is about aligning income potential, cost control, and management style. Some owners earn more through Airbnb; others prioritise stability. Both models offer valid opportunities in 2025.

If you want tailored advice on maximising ROI, our team specialises in property investment consulting Dubai. We help evaluate properties, model income potential, and design rental strategies focused on revenue optimization for landlords.

Book a consultation today to discover how your property can deliver stronger performance in Dubai’s evolving rental market.